All Categories

Featured

Table of Contents

[/image][=video]

[/video]

A set annuity is a retired life savings car that supplies tax-deferred accumulation at a guaranteed set rate for a fixed duration of time (typically 2 to 10 years). Simply put, the passion made in your repaired annuity is not strained until taken out, and the price of return is guaranteed throughout the multi-year term chosen.

You can likewise pick the period over which your annuity will be paid. Here are some usual alternatives: Straight life annuity-- You get an income for as long as you live.

This kind of annuity offers one of the most earnings per dollar of acquisition cash. It is suggested for someone who wants one of the most earnings possible and either has no dependents or has taken treatment of them through other ways. Life annuity with duration specific-- You obtain an income for as lengthy as you live.

Under some annuities of this type, the size of the repayments is reduced after the fatality of one of the annuitants. The straight life annuity gives even more earnings for your cash than any kind of other annuity.

And there is still one various other choice-- the matter of how your annuity repayments are connected to the insurance coverage business's financial investment returns. Under a fixed-dollar annuity, the insurance coverage company spends the money you pay in bonds and home mortgages with dealt with prices of return. You are guaranteed at least a specified minimum quantity in each annuity payout duration.

The account values of deferred agreements would certainly likewise boost. Under a variable annuity, the cash generally is bought ordinaries shares or other equity (possession) financial investments. The income you get will be linked straight to the marketplace worths of the investments and will certainly vary throughout the payout period.

Growth Annuity

Year-to-date (YTD) growth is also solid at 23%, showing enhanced need throughout all annuity types. This broad growth recommends an increasing rate of interest among capitalists seeking stability in unclear financial conditions.

Fixed-rate delayed annuities grew by 18% year-over-year, while indexed annuities saw a remarkable 54% quarterly development. This demand factors to a clear fad: several financiers like the protection of set returns, especially as interest prices stay elevated. Fixed annuities offer investors constant growth and guaranteed payments, making them appealing in today's economic environment.

Breaking down the information by item, variable annuities, RILAs, dealt with postponed, and taken care of prompt annuities all revealed substantial YoY gains. Fixed deferred annuities led the cost, growing by 33% over last year, while indexed annuities very closely adhered to.

The fads of 2024 indicate prospective for continued development in items like RILAs and indexed annuities. If financial unpredictability persists, these choices may stay popular as a result of their blend of development and security. Interest in fixed-rate and fixed-indexed products might stay strong if rate of interest remain to hold. Financiers looking to lock in steady returns may see annuities as a hedge against market fluctuations.

Suze Orman On Annuities

In current years, beneficial economic conditions and demographic shifts have driven need for financial investment security and ensured lifetime earnings services that are unique to annuity products. Jointly, annuity sales will exceed $1.1 trillion from 2022-2024.

Rates of interest are projected to continue to fall in 2025. Reduced interest prices will negatively impact sales development of FRD annuities, earnings annuities and, to a lower degree, FIAs. Rising cost of living will continue to be an economic element to view with 2027. Consumers will certainly want to annuity-type financial investments to equal inflation.

The united state populace ages 65 and over is anticipated to grow by greater than 7.5 million from 2023-2027. LIMRA's research shows annuity buyers have a tendency to be around 65, so this growth will produce a larger target market for revenue solutions. FRD products have actually driven the overall market growth, standing for over 40% of sales in 2023.

However the landscape is shifting. As rate of interest prices decrease, taken care of annuities may lose some charm, while products such as fixed-index annuities and RILAs gain traction. If you're in the market for an annuity in 2025, shop thoroughly, contrast options from the very best annuity firms and focus on simplicity and transparency to discover the right suitable for you.

When choosing an annuity, economic stamina rankings matter, however they don't tell the entire story. Below's exactly how compare based on their rankings: A.M. Best: A+ Fitch: A+ Criterion & Poor's: A+ Comdex: A.M. Ideal: A+ Fitch: A+ Moody's: A1 Criterion & Poor's: A+ Comdex: A.M. Ideal: A+ Moody's: A1 Standard & Poor's: A+ Comdex: A higher economic ranking or it just reflects an insurance company's monetary stamina.

If you concentrate just on rankings, you could The ideal annuity isn't just concerning firm ratingsit's around. That's why contrasting real annuity is more vital than just looking at financial toughness scores.

Annuity Inheritance Options

That's why it's necessary to obtain suggestions from a person with experience in the market. is an staffed by independent licensed financial professionals. We have years of experience helping people discover the best items for their requirements. And due to the fact that we're not affiliated with any kind of company, we can offer you unbiased guidance concerning which annuities or insurance plans are ideal for you.

We'll assist you arrange through all the choices and make the most effective choice for your situation. When choosing the very best annuity business to recommend to our customers, we employ a comprehensive method that, then from there that includes the adhering to requirements:: AM Finest is a specific independent rating firm that examines insurance firms.

, there are several alternatives out there. And with so several selections, understanding which is best for you can be hard. Go with a highly-rated firm with a strong credibility.

And lastly, choose an annuity that is very easy to comprehend and has no tricks. By adhering to these standards, you can be sure you're getting the most effective possible offer on a fixed annuity.: Oceanview Annuity since they often tend to have higher interest prices with conventional liquidity. ("A" ranked annuity business): Clear Springtime Annuity because they are simple, strong annuity rates and basic liquidity.

Some SPIAs offer emergency liquidity includes that we such as.

Annuities

There are a couple of key elements when looking for the ideal annuity. Contrast interest rates. A higher interest rate will supply more growth potential for your financial investment.

This can instantly boost your financial investment, yet it is important to comprehend the terms connected to the perk prior to spending. Lastly, think of whether you want a life time income stream. This type of annuity can offer satisfaction in retired life, yet it is vital to make sure that the revenue stream will certainly be ample to cover your needs.

Genworth Annuity Phone Number

These annuities pay a fixed regular monthly quantity for as long as you live. And even if the annuity runs out of cash, the regular monthly repayments will continue originating from the insurance provider. That suggests you can rest easy understanding you'll constantly have a stable income stream, no matter just how long you live.

While there are several various kinds of annuities, the very best annuity for long-term treatment expenses is one that will spend for many, if not all, of the costs. There are a few points to consider when picking an annuity, such as the size of the agreement and the payment options.

When picking a fixed index annuity, compare the available products to discover one that best suits your demands. Delight in a lifetime earnings you and your partner can not outlive, giving economic security throughout retired life.

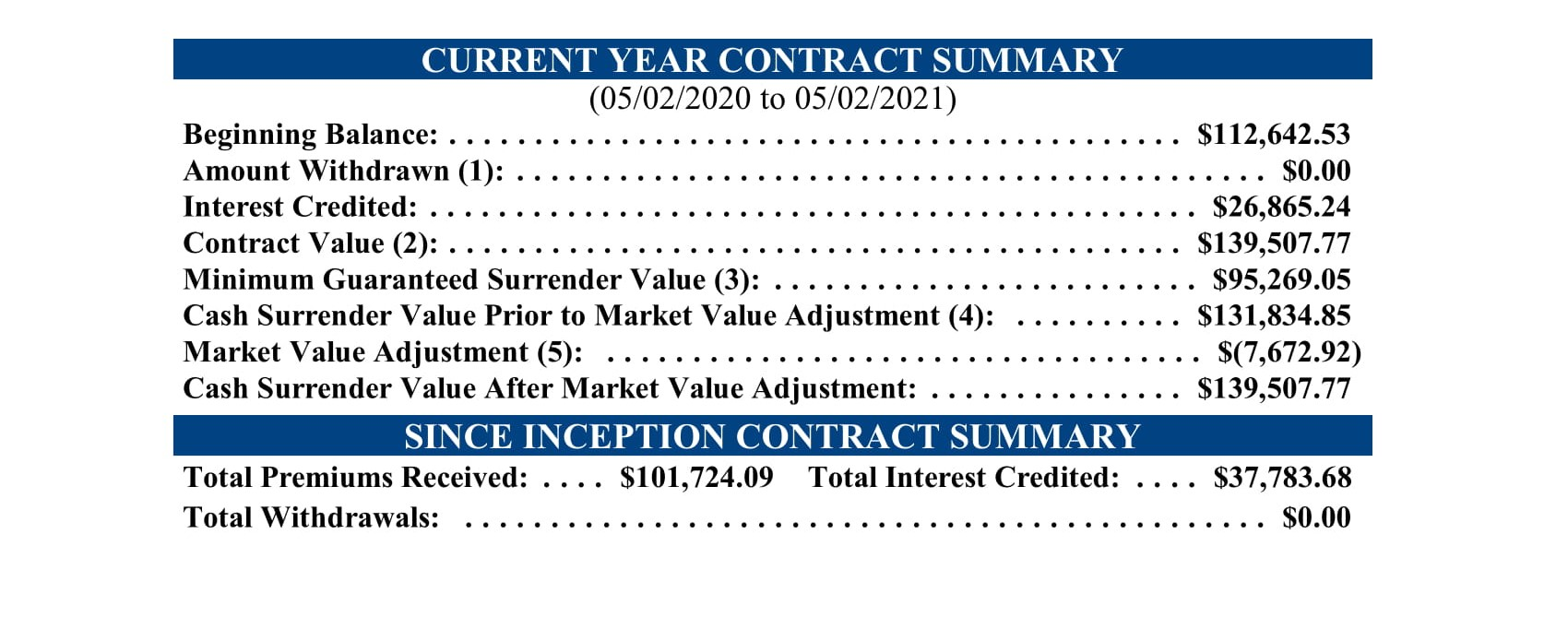

These annuities illustrate the greatest returns (hypothetically). The image listed below is a bit from my annuity to offer you a better idea of returns. There are a few essential elements to consider when locating the finest annuities for elders. Based upon these requirements, our suggestion for the would certainly be American National. Additionally, they permit as much as 10% of your account value to be withdrawn without a fine on many of their product offerings, which is more than what most other insurer enable. Another variable in our recommendation is that they will certainly permit senior citizens up to and including age 85, which is also greater than what some other business permit.

The very best annuity for retired life will depend upon your specific needs and goals. Some attributes are typical to all appropriate retirement annuities. An appropriate annuity will certainly give a consistent stream of revenue that you can rely on in retirement. It needs to additionally supply a secure financial investment option with prospective development without threat.

An appropriate annuity needs to also provide a death advantage so your liked ones are cared for if you pass away. Our referral is. They are and consistently offer several of the highest payouts on their retirement revenue annuities. While rates change throughout the year, Integrity and Assurance are typically near the top and keep their retired life earnings affordable with the various other retirement earnings annuities in the marketplace.

Security Benefits Annuities

These ratings provide customers a concept of an insurance policy company's financial security and how likely it is to pay out on cases. However, it's crucial to note that these scores do not always mirror the top quality of the products used by an insurance company. An "A+"-ranked insurance policy firm might offer products with little to no development potential or a lower revenue for life.

Your retired life savings are likely to be one of the most essential investments you will ever make. If the insurance business can not attain an A- or far better ranking, you must not "wager" on its competence long-term. Do you want to gamble cash on them?

Table of Contents

Latest Posts

Polaris Variable Annuity

Can I Borrow Money From My Annuity

Ny Life Annuity Rates

More

Latest Posts

Polaris Variable Annuity

Can I Borrow Money From My Annuity

Ny Life Annuity Rates